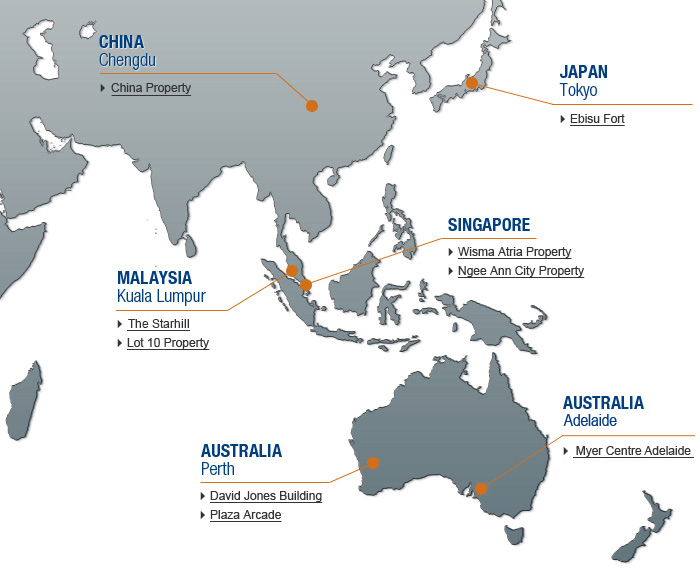

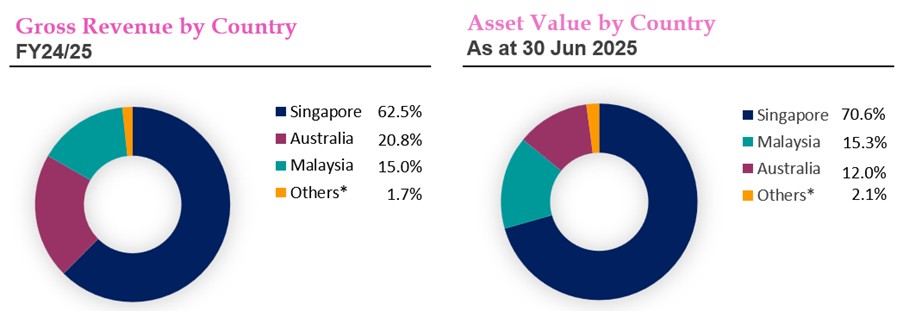

Starhill Global REIT's portfolio comprises mainly retail assets which include nine mid- to high-end properties over six cities in Asia-Pacific. Core markets Singapore, Australia and Malaysia make up approximately 98% of the total asset value as at 30 June 2025.

*Others comprise one property each in central Tokyo, Japan and Chengdu, China, respectively.

| Portfolio Property Value | ~S$2.8 billion |

| Committed Portfolio Occupancy Rate | 94.6% |

| WALE | 7.2(1)(2) and 7.6(1)(2) years |

By NLA and gross rental income respectively (as at 30 June 2025)

- Based on committed leases as at 30 June 2025, including leases commencing after 30 June 2025. Based on the date of commencement of leases, portfolio WALE was 7.1 years by NLA and 7.5 years by gross rental income.

- Excludes tenants' option to renew or pre terminate. Assumed options to renew by either landlord or master/anchor tenant for Toshin and David Jones leases have been exercised.