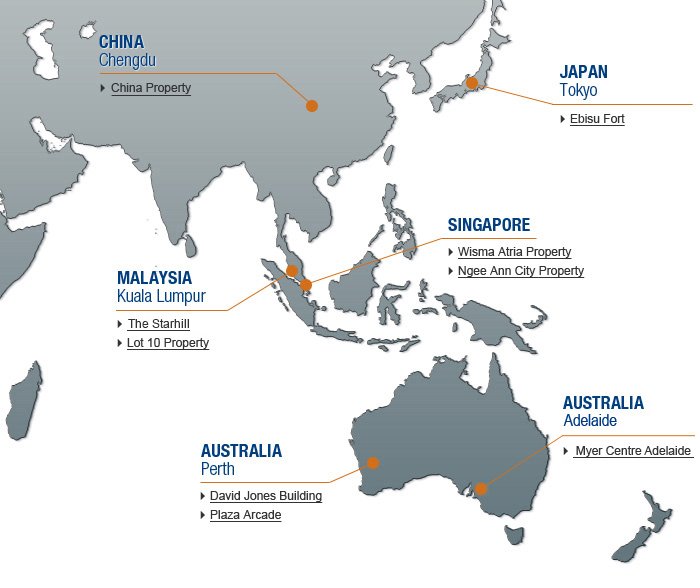

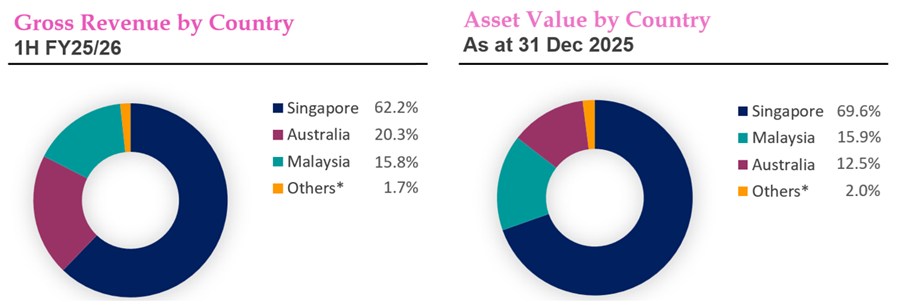

Starhill Global REIT's portfolio comprises mainly retail assets which include nine mid- to high-end properties over six cities in Asia-Pacific. Core markets Singapore, Australia and Malaysia make up approximately 98% of the total asset value as at 31 December 2025.

*Others comprise one property each in central Tokyo, Japan and Chengdu, China, respectively.

| Portfolio Property Value | ~S$2.8 billion |

| Committed Portfolio Occupancy Rate | 91.9% |

| WALE | 7.2(1)(2) and 7.4(1)(2) years |

By net lettable area ("NLA") and gross rental income ("GRI") respectively (as at 31 December 2025)

- Based on committed leases as at 31 December 2025, including leases commencing after 31 December 2025. Based on the date of commencement of leases, portfolio WALE was 7.1 years by NLA and 7.3 years by GRI.

- Excludes tenants' option to renew or pre-terminate. Assumed options to renew by either landlord or master/anchor tenant for Toshin and David Jones leases have been exercised.